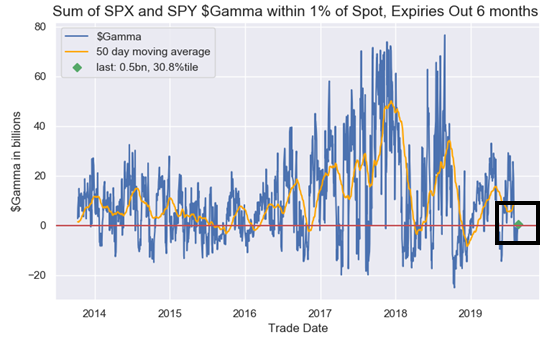

The good news is that ‘dealer gamma’ has normalized in the last week, and as Nomura’s Charlie McElligott notes, we should see a more stable / insulated and less “chase-y” trading environment which can engender further restoration of sentiment.

.png)

The bad news is coming though. McElligott warns that September poses its own set of challenges and should continue to keep directional trading “tactical” in nature:

- Both Fed and ECB “dovish expectations” remain exceedingly HIGH and thus risk a perceived “hawkish disappointment,” which could then dictate US Rates (higher yields) and USD (higher) price-action which could then act to “TIGHTEN” financial conditions

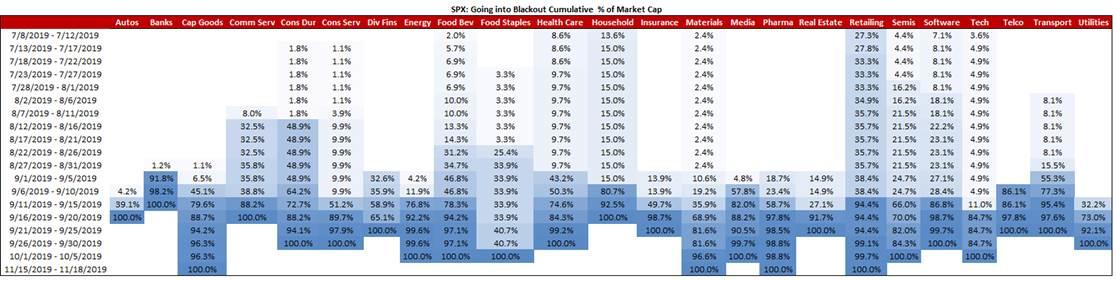

- Additionally, we will see the resumption of the “buyback blackout” around mid- September into Q3 EPS season, as we estimate ~75% of S&P 500 corporates will see their purchase windows close by 9/17/19

Thus as we have experienced so many times before, any “macro shock as catalyst for lower Equities” (e.g. September Fed or ECB disappointment) then risks the following sequencing:

1) a drop in spot back into Dealer “Short Gamma” zone, which too then could converge with…

2) the increased potential for recently / currently RE-leveraged “Long Equities” positions (or at least covering “Shorts”) from Target Vol / CTA Trend accounts which could then to see a forced DE-leveraging upon a large enough drop - ESPECIALLY in-light of…

3) the mid-Sept gradual loss of the “Buyback Bid” and…

.png)

4) VIX September seasonality, which is the 2nd best avg monthly return for the volatility index in its history.

.png)

Source: Bloomberg

And all that can save the world is the promise of moar from Powell, Draghi, Lagarde, Kuroda, et al… But McElligott is unsure of whether Powell can thread the needle.

The narratives surrounding “end-of-cycle now being accelerated into by trade war” views ON TOP OF a growing belief in the exhaustion of monetary policy (i.e. Japanese Yen +3.5% vs USD over the past 3m /+4.2% vs USD over past 6m) continues to act as the macro catalysts for capitulation into the “perpetually lower yields and flatter curves” mentality from investors.

Source: Bloomberg

The resumption of curve (bull) flattening by midday yesterday (reversing earlier bear-steepening) and continuing again into today speaks to the likely ongoing FLOW demand from various assorted “convexity-sensitives / hedgers” in order to close their “duration gaps” which have violently accelerated over the past few weeks:

Source: Bloomberg

i.e. Asset Liability Managers (Pensions / Insurance); Bank Portfolios; and Mortgage-related players (GSEs, Servicers but particularly LEVERAGED types like MF HF’s and M-REITS) who effectively become “mechanical buyers of duration,” especially on any nascent cheapening like the pullback experienced yesterday morning.

Source: Bloomberg

Risks from here on this momentum “duration grab” becomes a disappointing Powell at Jackson Hole IF he were to attempt to walk-back continued market expectations for a more aggressive Fed easing path, which in light of the mechanical “crowding into” USTs / Rates / Receivers could “tip over” late-comer positioning.

via zerohedge