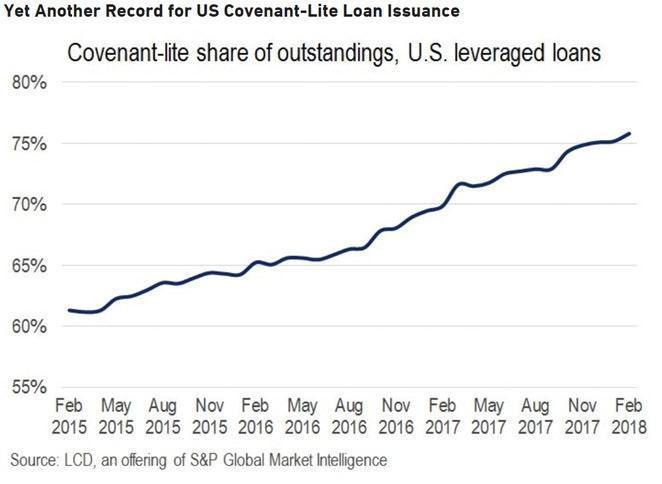

Back in 2018, the list of voices speaking up about the risks inherent in the leveraged loan market, included the who is who of financial icons and regulators among them the IMF, Fed, BIS, JPMorgan, Guggenheim, Jeff Gundlach, and Howard Marks (as we documented back in December)with even Janet Yellen chiming in that declining underwriting standards for corporate loans could lead to more bankruptcies and prolong the next economic downturn.

Now we can add the CEO of one of the largest US bank (not to mention one of the largest loan issuers in the US).

Speaking at the Economic Club of New York, Bank of America CEO Brian Moynihan, warned that the U.S. economy is on solid footing except for one potential trouble spot: leveraged loans.

As Bloomberg reports, Moynihan said that his bank has repeatedly said it focuses on “responsible growth” and sticks to lending standards it’s had for years. Yet, in somehow trying to split hairs, he said that leveraged finance threatens to become an issue in the broader market, he said.

“It’ll be ugly for those companies if the economy slows down and they can’t carry the debt and then restructure it, and then the usual carnage goes on,” Moynihan said, echoing Yellen in bringing attention to collapsing covenant protections and weakening terms in the wider market for riskier corporate lending.

“We don’t see anything yet because the economy’s good, the companies are making money,” Moynihan said on Tuesday. “The issue that’s there is in the leveraged finance.”

The irony, of course, is that issuance of leverage loans is a business that Bank of America has dominated for a decade, and is sits atop the league table for leveraged-loan bookrunners for the 10th consecutive year, according to data compiled by Bloomberg. Infact, as Bloomberg commentator James Crombie pointed out, “BofA has sold most of these loans.”

btw, BAML sold most of these loans https://t.co/19LjbodSkR via @markets

— James Crombie (@jtcrombie) June 5, 2019

Moody’s recently said covenant quality for Q4 2018 was close to a record low, and the rating company sees no signs of improvement this year.

The trend toward weaker terms is something “we should worry about,” Moynihan said. “We aren’t lowering standards because we tried that once and it didn’t work so well,” he said, to laughter in the audience. The laughter in a few years when BofA has to be bailed out again will be far more muted.

The leveraged loan market is relatively small, meaning any shakeout is less likely to affect broader markets, according to Moynihan. The “real debate” belongs with the leveraged finance deals that are done outside of banks, Moynihan said — echoing views of financial watchdogs who’ve expressed concerns that risk has shifted outside their purview.

Not helping, last month Fed chair Powell said that the market looks a lot like the mortgage industry in the run-up to the subprime crisis. “But U.S. regulators are watching closely this time around and the financial system is better shielded”, Powell said, not actually believing his words.

Why is Moynigan’s warning especially ironic? Because in just 2019, Bank of America has been the bookrunner on some $317 billion of leveraged loans, accounting for 10.8 percent of the market share. That compares with $688 billion for last year, when Bank of America led the loan portion of Blackstone Group’s buyout of Thomson Reuters Corp.’s Refinitiv unit. Leveraged loan volumes this year have dipped amid a flight from riskier assets and as investors pull money from loan funds as a pause in rate hikes dims their allure.

Besides the increasingly troubled credit market, Moynihan said overall economic activity and confidence remain strong among U.S. consumers and businesses. Even a recent slowdown in capital expenditures by businesses is consistent with a healthy economy, he said, adding that strong underlying economic data are more important indicators of growth than the possibility of a recession signaled by an inverted yield curve.

In a final irony, Moynihan’s testimony took place at the same time as the House Committee on Financial Services conducted a hearing today titled: “Emerging Threats to Stability: Considering the Systemic Risk of Leveraged Lending.” As Grant’s Interest Rate Observer, Philip Grant wrote last night, “an analysis of the leveraged loan market (“Tomorrow’s debt hearings”) in the July 13, 2018 edition of Grant’s Interest Rate Observer predicted that a cyclical crack-up would lead to unwanted (for industry practitioners) attention from Washington.” He was right. This is what else he said:

That July 2018 examination identified the erosion of creditor protection via widespread cov-lite documentation, deteriorating credit quality and aggressive earnings additions or cost-savings assumptions from issuers, called add-backs that can artificially inflate projected results. As noted by S&P’s LCD unit in a report last year, loans related to mergers and acquisitions are particularly susceptible to such add-backs of late, with a record 22% of M&A related-loans featuring add-backs greater than 50% of EBITDA in the first half of 2018, double the pre-2008 high.

Despite a suddenly-wobbly stock market, the M&A train keeps rolling. According to data from Bloomberg, more than $40 billion in corporate transactions were logged yesterday, the second-busiest deal day of the year.

Credit quality continues to wane. As noted by investment fund Driehaus Capital Management, LLC’s Twitter account this morning, the proportion of loans rated double-B (the high end of junk territory) now foot to less than 30%, down from 50% at the beginning of 2008. Single-B-rated issuers now comprise nearly 30% of loans, up from less than 10% in early ‘08.

The shift in the average leveraged loan rating since the crisis is quite notable. From 50% BB back in Jan08 to <30% now, as single B loans became the tranche of choice. YS #DriehausAltspic.twitter.com/iP7L36HYXB

— Driehaus (@DriehausCapital) June 4, 2019

Those red flags haven’t yielded much pain yet, as the S&P/LSTA Leveraged Loans Index has returned a solid 5.5% year-to-date, while LCD reported yesterday that the May default rate registered a skinny 0.93%, well below its historical average of 2.93%. But some investors aren’t waiting around: According to Bloomberg, the Invesco Senior Loan ETF saw its largest funds outflow on record yesterday.

via zerohedge

I’ve been a loyal customer of BOA for over 25 yrs. and I don’t do well with “needless warnings”.. I think it’s about time I moved on to another bank who doesn’t try to push threats to people.. BOA to me is opposing our great nation with this and I’m ready to move on..

I have refused to do any business with BofA since I had an account with them at a time that I was struggling to get by. At least once a month, often more, when the account was down to the last few dollars, they would assess some ‘mystery’ fee, just enough to overdraw the account by 10 or 15 cents, to collect the overdraft fees. Every paycheck, they would take 30 or 60 dollars off the top for the fees. If they still treat their customers that way, well, they might currently be the largest, but they are not the only show in town, and not ‘too big to fail’.