Update: In Powell’s full interview, below, the Fed Chair says that the Fed is “independent” and acts in a non-political way, serving all Americans.

Earlier:

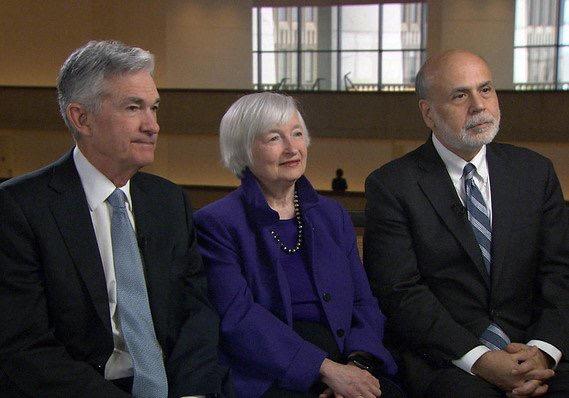

A decade after Ben Bernanke appeared on “60 Minutes”, vowing that the Fed could easily crush inflation, as it could “raise interest rates in 15 minutes”, of course with the occasional “pause” along the way should the S&P dip by 20% or so, current Fed Chairman Jerome Powell will follow in his footsteps on Sunday night, when surrounded by former Fed Chairs Bernanke and Yellen, he will try to reach beyond the Fed’s traditional audience of markets, journalists and lawmakers to counter the attacks from President Trump, even after the Fed’s paused on raising interest rates, said Sarah Binder, a professor of political science at George Washington University, quoted by MarketWatch.

“He wants to counter the president’s message that policy is all wrong,” Binder said.

Binder said she was struck by the still photo of the “60 Minutes” interview that shows Powell alongside his two predecessors Janet Yellen and Ben Bernanke.

“This puts a human face on the central bank. It says, ‘we’re the Fed and we’re here to help,’” Binder said.

Bernanke also faced criticism when he went on “60 Minutes” in March 2009. The Fed was facing concerted attacks by lawmakers and populist “End the Fed” groups, who considering the record wealth divide in the US created by the central bank, were spot on.

Robert Brusca, chief economist at FAO Economics, said Powell may also try to restore some enthusiasm in the outlook for the economy, especially in light of the collapse in Q1 GDP estimates.

Ironically, Trump was right in calling for an end to the Fed’s rate hikes, as the Fed itself confirmed, albeit indirectly. In December, the Fed had penciled in two interest-rate hikes into its dot plot. Then in January, Powell - once again flanked by Bernanke and Yellen, almost as if in hopes of deflecting attention, reversed course and said he didn’t know if the next move would be rate hike or a cut.

The Fed chairman wants to make sure his wait-and-see attitude “isn’t taken as an indication that something is wrong with the economy,” Brusca said although considering the near record plunge in retail sales, the sharp drop in payroll growth and the declining GDP estimates for the first quarter.

Meanwhile, Tim Duy of the University of Oregon said the Fed chairman wants to push back on the idea that this policy switch was due to Trump’s pressure.

“It is no secret that last fall the president was harping on the Fed and Powell and suddenly it looks like the Fed has a complete change of heart,” Duy said.

“It would be easy [for the casual observer] to take away a message that Fed caved to Trump pressure,” Duy said.

Alternatively, it would be just as easy for the casual observer to conclude that Trump had a better grasp of the economy than the Fed, much to Yellen’s chagrin.

Of course, as Mizuho’s chief economist Steven Ricchiuto, said the recent weak data shows the Fed made the correct call to move to the sidelines.

“Their [tightening] policies were much too quick. Trump called them out on it,” adding that it wasn’t politics that caused the Fed to change. “They reassessed the situation and realized they made a mistake,” he said.

* * *

In any case, according to an early look at what Powell will say courtesy of Bloomberg, the Fed chair will repeat that interest-rate policy “in a very good place right now”, and that the Fed is in no hurry to change rates.

Powell will say that the Fed won’t overreact to inflation modestly above 2%, i.e., the Fed will accept an inflationary overshoot which is good news for markets as it means the Fed won’t rush to hike even if inflation keeps rising (as it has been, or rather soaring if measured accurately), and will say that “the U.S. outlook is a positive one.”

Powell will say that financial conditions are generally healthy, credit spreads and stock market are at normal levels.

More importantly, the Fed chair will say that he didn’t stop rate hikes because of pressure from President Donald Trump, and that he plans to serve his full four-year term, adding that Trump can’t fire him while declining to comment on Trump’s criticism of the central bank.

On deciding the direction of interest rates, he says “we’ll be looking at a range of data. For here domestically, we’ll be looking at growth, we’ll be looking at the state of the labor market, job creation, wages and that kind of thing. We’ll also be looking at inflation, of course. And abroad, we’ll be looking to see how foreign growth is evolving, particularly in China as I mentioned and in Europe.”

In other words, Powell will once again use the great deflection routine, claiming that the US is doing great, and it’s everyone else that is at fault for the Fed “pausing.”

via zerohedge

This antitrump talk from the new Fed chair is unwarranted and ill advised. Its directly due to President Trumps economic policies that the econonmy is bursting at the seems and taking pressure off the Fed. His inability to reocgnize that exposes him as an ideologue like recent Fed Chairs and under the thumb of the socialists which is a bad sign. Since President Trump nominated him it reveals that he still has deep state traitors in his Staff that he still trusts. He needs to wake up quick before they take him down.

Wow, I didn’t realize that the president couldn’t fire the Fed Chairman. Does that mean that he is free to do as he pleases with no oversight and no one able to fire him? How do we get these untouchables as we have in the DOJ, & the SCOTUS! Of course, the President can be fired by congress.