Authored by Robert Kesler via KesslerCompanies.com,

Inflation has once again become a hot topic of discussion.

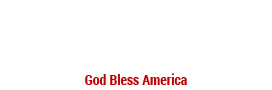

Core CPI has returned to 2%, oil is near $70 a barrel, and copper is well over $3 per pound. What is easily forgotten, yet not hard to show, is that inflation is the last of the lagging indicators. In fact, headline CPI is best correlated to the economy (coincident indicators) with a 21 month lag!

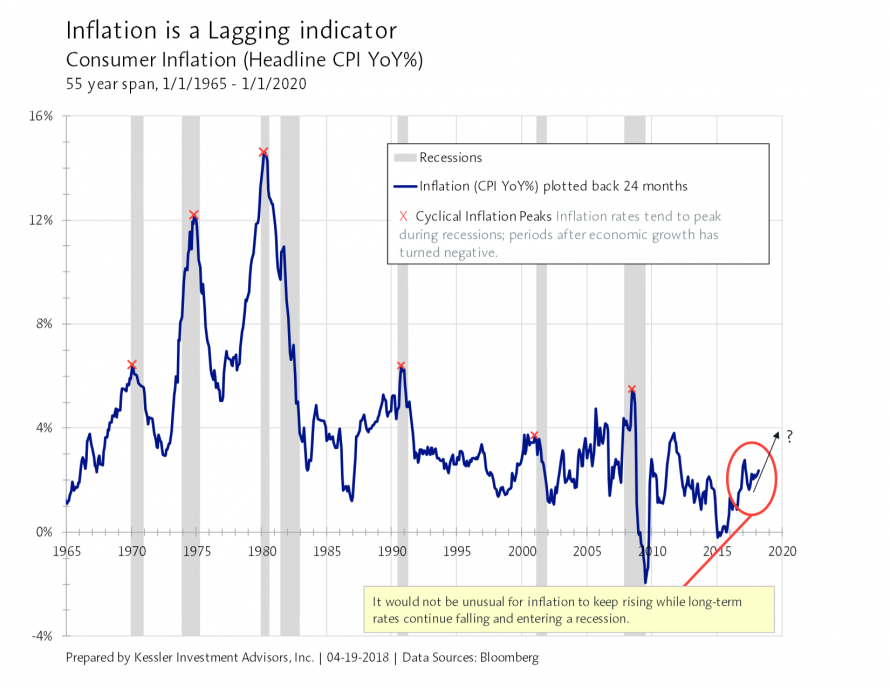

The chart below shows that inflation tends to reach its peak well after the recession has begun. In our most recent recession, from 12/2007 – 06/2009, CPI peaked in July of 2008, Copper peaked on 7/2/2008 and Oil peaked on 7/3/2008. This was in the middle of recession, a full year after interest rates had peaked and nine months after the stock market peaked.

While counter intuitive, it would not be unusual for inflation to continue climbing as we get closer to a recession as interest rates continue to fall. Interest rates are much more interested in the outlook for future inflation than what it has measured in the last 12 months.

The lagging inflation surge of 2008 did affect interest rates negatively, but only temporarily (3 months), and within a much bigger primary trend of falling interest rates (see above).